Is There an AI Bubble in 2025? Hype, Hope, and Hard Numbers Behind Tech’s Latest Wild Ride

Introduction: Grappling with the Hype Machine

Artificial intelligence (AI) has morphed from academic curiosity to global economic engine at phenomenal speed. In just under three years, investment, expectations, and media attention have ballooned to dizzying heights, with generative AI leading the charge across industries—from code generation and customer service to biotech, logistics, and creative fields. “AI is poised to be the most transformative technology of the 21st century,” proclaims Stanford HAI’s 2025 AI Index, echoing the sentiments of venture capitalists, C-suite leaders, and a chorus of tech evangelists.

But as 2025 unfolds, a different narrative is bubbling up. Headlines allude to “froth,” “overvaluation,” and a yawning chasm between AI’s promise and its performance. From Wall Street to Silicon Valley, a critical question echoes: Is this the prelude to an “AI bubble” poised to burst—echoing dot-com mania and the fizzled blockchain hype, or is it the rocky awakening before another decade of unstoppable transformation? In this blog post, we’ll dive deep into what’s real, what’s overblown, and what the numbers, experts, and history suggest about AI’s trajectory in 2025.

What Is the ‘AI Bubble’—And Why Are We Even Talking About It?

The notion of a tech “bubble” is hardly new. In economic terms, a bubble occurs when investment and asset prices rise far above the underlying value and earning potential of a technology or sector—typically fueled by hype, fear of missing out (FOMO), and unrealistic expectations. Bubbles infamously burst when reality under-delivers, leading to rapid deflation of valuations, company failures, layoffs, and sometimes, broader economic pain.

The AI bubble, as it’s theorized in 2025, refers to the potential misalignment between extraordinary investment and AI’s measurable, real-world impact. It describes a climate where startup valuations soar independently of demonstrated ROI, Big Tech companies pour billions into data centers and research, and mainstream business eagerly anticipates revolutionary productivity gains—despite mounting evidence that results remain patchy and inconsistent. The skepticism isn’t about AI’s long-term potential but about whether current spending and expectations are sustainable in the nearer term.

Expert Warnings: “There’s Absolutely a Bubble”

As investor Tom Siebel (CEO of C3.ai) bluntly declared, “The market is overvaluing AI. There’s absolutely a bubble”. And he’s not alone. OpenAI CEO Sam Altman, whose company arguably catalyzed this AI whirlwind, candidly stated in August 2025: “Investors as a whole are overexcited about AI” and that “an AI bubble is ongoing”.

Academic leaders are equally cautious. The MIT Media Lab’s 2025 report, after reviewing 300+ AI projects and surveying industry executives, found that 95% of generative AI initiatives fail to generate measurable ROI—a statistic that sent ripples through markets that briefly wiped $1 trillion off tech stocks’ value this year. Gartner’s 2025 Hype Cycle for AI bluntly reports that GenAI is firmly in the “Trough of Disillusionment,” noting, “Despite an average spend of $1.9 million on GenAI initiatives in 2024, less than 30% of AI leaders report their CEOs are happy with AI investment return”.

Key Quotes:

- “The influx of money pumped into GenAI without clear ROI has inflated expectations to unsustainable levels.” – Adi Andrei, AI/ML expert

- “People would be disappointed that the technology doesn’t meet the high expectations generated through the initial excitement …. only about 1% of companies will endure when the AI hype fades.” – Baidu CEO Robin Li

- “Even OpenAI CEO Sam Altman, who helped spark the AI boom, warns that the market may be overheating. He and other investors mention soaring valuations, too much money chasing unproven business models, and the risk of building infrastructure faster than demand will justify.” – Paulo Carvão, Harvard/Forbes

- “AI measurement is a mess—a tangle of sloppy tests, apples-to-oranges comparisons, and self-serving hype …” – Kevin Roose, The New York Times

A Tale of Three Tech Cycles: Dot-Com, Blockchain, and the AI Surge

To make sense of the AI bubble debate, let’s take a whirl through recent tech history and see how today’s anxieties compare.

| Feature | Dot-com Bubble (1995–2000) | Blockchain Hype (2016–2021) | AI Boom / "Bubble" (2023–2025) |

|---|---|---|---|

| Peak Investment | $6.7T (NASDAQ, 2000) | ~$2T (Crypto, 2021) | $402B (Tech Giants, 2026 est.) |

| Valuation Disconnect | 100–1000x sales for startups | Coin/token mania (NFTs, ICOs) | 50x+ sales for AI, multi-billion $ pre-revenue startups |

| Adoption Speed | Explosive, then bust (startups) | Variable, retail-driven | Rapid: 78% of orgs using AI by 2024 |

| Regulation | Minimal | Patchy/global mismatch | Rapidly increasing (EU AI Act, US Exec Orders) |

| ROI Reality | Bust for most; infrastructure useful | Some (DeFi, supply chain) | Still elusive: 95% GenAI projects ROI-negative |

| Layoffs/Correction | Severe, mass layoffs | 2018–2022 "Crypto Winter" | Mass layoffs surging in 2025 (130,000+ jobs lost) |

| Public Perception | Overhyped, then cynical | Distrust after scams | Divided: execs trust AI, public is skeptical |

| Market Effects | S&P 500 fell ~50%, trillions lost | Crypto lost 80%+ in value | $1T+ wiped off in August 2025 selloff |

| Tech Aftermath | Google/Amazon survive & thrive | DeFi foundation persists | AI expected to reshape long-run winners despite busts |

Table adapted and updated from Gartner and sector reporting.

Analysis:

All these cycles share core patterns: wild investor exuberance, a flood of capital into startups (many failing fast), and a reckoning when technology struggles to produce short-term payoffs. But the ultimate survivors of each tech hype cycle (Amazon, Google, Bitcoin, Ethereum, etc.) did become keystones of the global economy. The catch? It took far longer and required far more pain and weeding-out than the hype ever admitted.

Hard Numbers: Investment and Adoption in the AI Boom

Historic Capital Flows

In 2024, U.S. private AI investment hit $109.1 billion—nearly 12 times China’s $9.3 billion and 24 times the U.K.’s $4.5 billion. Generative AI alone drew $33.9 billion globally in funding—an 18.7% increase from 2023 and up 8.5x from two years ago. Venture deals involving OpenAI, xAI, Anthropic, Waymo and Databricks accounted for 43% of all venture capital dollars in Q4 2024.

Corporate mega-spending is even more staggering: Microsoft, Meta, Alphabet, and Amazon together are projected to spend over $320 billion on AI and data centers in 2025. Amazon alone is doubling its capital investment. Nvidia, meanwhile, became the world’s first $4 trillion public company, powering these AI ambitions with its chips.

Adoption Metrics

As of 2024/2025, 78% of global organizations are using AI in at least one business function (up from 55% in 2023). Daily employee users of AI more than doubled in a year, from 4% to 8%. Generative AI use (i.e., text/image/video tools) soared from 33% to 71%.

Yet underneath those stats lies a sharp productivity paradox.

The Great AI Productivity Paradox: Where’s the Payoff?

A key trigger for “bubble” fears is the striking gap between AI spending and evidence of bottom-line impact.

Investment Outpaces Returns

- MIT Media Lab’s 2025 “State of AI in Business”: Reviewed 300+ AI projects, 95% of pilots delivered zero measurable ROI. Only 5% delivered meaningful revenue acceleration. Market reaction: $1 trillion wiped off mega-cap tech stocks within days after the report.

- The Atlantic (2025): AI startups pulled in $44B in H1 2025, but firms have invested over $500B in AI for only ~$35B earned back. Economists at Pantheon estimate AI spending added 0.5 points to GDP growth—suggesting the US economy would have expanded <1% without it.

Productivity Experiments: Results Underwhelm

- Model Evaluation & Threat Research (METR) Study: Experienced developers working with AI completed tasks 20% slower than those working unaided—a result that shocked even the researchers. “Developers ended up spending a lot of time checking and redoing the code that AI systems had produced—often more time than it would have taken to simply write it themselves,” the study found. The anticipated productivity gains simply did not materialize.

- Real-World Data: ChatGPT and similar agents could finish just 24% of assigned business tasks without significant human revision. Efficiency gains proved elusive; in many office settings, even advanced AI managed only about 30% success on core tasks.

- Other Trials: While studies sometimes show 10–14% improvements in speed for basic tasks (especially with junior or entry-level workers), the results fall far short of macroeconomic expectations, and in some domains, quality and novelty suffered.

The Capability-Reliability Gap

The “capability-reliability gap” looms large: AI models dazzle on benchmarks and in demos, but consistently falter in real-world, high-stakes business contexts. Errors, hallucinations, and the need for human “verification tax”—the time employees spend double-checking and correcting AI output—dramatically erode perceived efficiency gains.

Economic Implications: When the AI Bubble Bursts

What happens if the AI hype wheezes out, or worse, pops? The risks aren’t confined to a handful of overvalued startups. Here’s what’s at stake:

1. Mass Layoffs and Restructuring

An industry-wide productivity letdown fuels layoffs, hiring freezes, and business restructuring as firms scramble to contain costs. In 2025 alone, more than 130,000 tech jobs have been cut directly due to AI-driven automation or strategic pivots toward AI spending.

- Big Tech Examples:

- Microsoft: 15,000+ jobs cut in 2025, following an $80B+ AI investment spree.

- Meta: Froze AI hiring after rapid ramp-up; 3,600 layoffs in Q2-Q3 2025.

- Salesforce, Oracle, TCS, IBM, Canva, Bumble, Chegg: Each announced hundreds to thousands of cuts, with many roles replaced by AI chatbots or automation software.

- Intel: Plans to reduce workforce by up to 25,000 roles, shifting focus to AI semis.

- Chegg: 240 jobs (22%) lost as students prefer ChatGPT for study help.

- Global Reach: Layoffs stretch from Silicon Valley’s Bay Area to India’s Bangalore, disrupting communities once thought invulnerable to tech disruption.

2. Market Correction and Shaken Investor Confidence

When numerous startups and public companies dependent on AI revenue fail to deliver returns, investors sell off. The August 2025 market “yo-yo” saw $1 trillion in market capitalization erased from tech’s “Magnificent Seven” stocks in under a week. High exposure indexes (Nasdaq, S&P 500) become sensitive to AI headlines, and analysts warn of “systemic risk” due to the unprecedented market concentration in leading AI stocks.

- “If AI fails to deliver promised returns, a sell-off could wipe out trillions, just as with the NASDAQ’s 78% drop in 2000–2002”.

- Economists warn that AI sector shocks could ripple across the broader economy because AI spending now materially supports GDP growth, tech employment, and even commercial real estate via data center booms.

3. Consumer Confidence and Economic Growth

Should the AI “miracle” fall flat, the ripple effects—through layoffs, deflated retirement accounts, and delayed productivity gains—could curb spending, foster public skepticism, and threaten economic growth.

Why Isn’t AI Producing Immediate Payoff? Understanding the “J-Curve” and Tech Hype Dynamics

The disconnect between soaring investment and slow productivity impact isn’t unique to AI; it’s a historical hallmark of general-purpose technologies.

The Productivity J-Curve

Stanford’s Erik Brynjolfsson characterizes technology adoption with the “productivity J-curve.” Early years see heavy investment and workflow disruption, when productivity may actually dip. Only later, after invisible improvements (systems integration, new job roles, organizational change) and process innovation, do gains manifest at scale.

Electricity in the late 19th century is a classic analogy: It took decades before the factory floor was reimagined to exploit electric motors’ full potential. The internet, too, triggered years of overspending, bust, and only later the emergence of Google, Amazon, and digital commerce as society’s backbone. AI in 2025 is on a strikingly similar path.

The Gartner Hype Cycle

Gartner’s famed “Hype Cycle” models all tech fads:

- Innovation trigger — breakthrough and enthusiasm.

- Peak of Inflated Expectations — frenzied investment, media hype.

- Trough of Disillusionment — hype outpaces reality, failures pile up.

- Slope of Enlightenment — lessons learned, real workflows built out.

- Plateau of Productivity — mature and valuable use cases dominate.

As of 2025, GenAI is solidly in the “Trough of Disillusionment,” according to Gartner, with practical business value lagging well behind spending and expectations.

Lessons from Dot-Com and Blockchain Hype

The dot-com crash of 2000 saw $5+ trillion in value evaporate, but also birthed Google, Amazon, and the cloud infrastructure that powers today’s digital world. Blockchain and crypto, though infamous for scams and boom-and-bust cycles, have likewise spurred ongoing adoption—DeFi, supply chain, NFT use-cases—beyond the initial busts.

Key lessons for AI in 2025:

- A brutal shakeout is normal: Up to 95% of companies may fail, but resilient, innovation-driven survivors can become industry titans.

- Infrastructure investment (fiber optics, data centers, chips) is rarely wasted long-term—even if short-term returns are elusive.

- Premature focus on killer apps or “overnight” transformation fuels the bust; real progress emerges from iterative, workflow-level change.

- The presence of a bubble doesn’t preclude ultimate paradigm-shifting impact. “People overestimate what they can do in one year and underestimate what they can do in 10 years.” (Bill Gates).

AI and the Real Economy: Job Creation and Displacement

Big Impact on Jobs—But Finding the Net Effect Is Tricky

AI is simultaneously eliminating jobs (especially routine and administrative roles) and creating new ones—especially for those with tech skills or the ability to “AI-supervise” or collaborate with automated systems.

By the Numbers:

- 97 million jobs forecast to be created by AI by 2025 (World Economic Forum).

- 85–92 million jobs forecast to be displaced in the same period.

- Net +12 million jobs—though with significant regional and skill-level variation.

However, for certain sectors, like tech, publishing, finance, and HR, the job loss/disruption is very real and visible in 2025.

Sector-Specific Impacts

- Routine knowledge work: Support, HR, entry-level programming, and basic documentation roles most at risk for AI-driven layoffs.

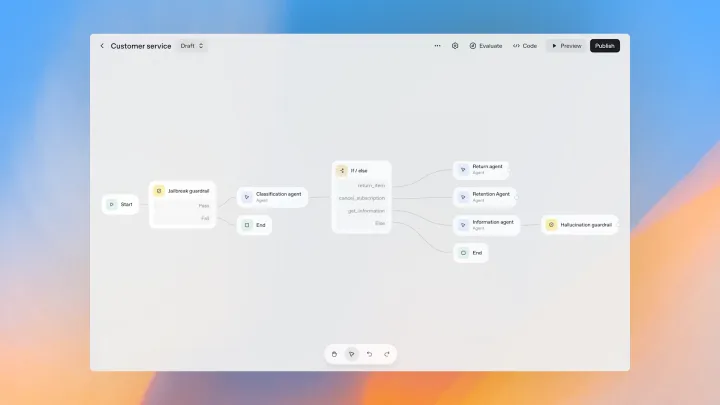

- Customer service: Salesforce credits its “Agentforce” AI with reducing the need for hundreds of human support engineers.

- Software engineering: AI tools like GitHub Copilot mean junior coding tasks can be automated—leading Microsoft to cut up to 40% of layoffs among developers this year.

- Strategic knowledge work: Roles involving supervision, judgment, and domain expertise prove harder for AI to displace.

Future-Proofing: Skills That Survive & Thrive

Strategic thinking, creativity, complex decision-making, and interpersonal communication are vital. “Workers who understand these systems and can use them to their advantage are more likely to stay relevant,” notes industry commentary. Governments and companies are investing in massive retraining and upskilling initiatives, though access remains uneven.

Environmental Risk: AI’s Exploding Resource Footprint

Amid all the excitement, AI’s rising energy, water, and hardware demands have triggered mounting scrutiny—from activists, regulators, and even investors. Key stats:

- AI accounted for 11–20% of all data center electricity use in 2024. By 2030, AI could use nearly half of global data center power, with workloads growing 30% annually.

- Training GPT-4: Consumed over 50 gigawatt-hours—enough to power San Francisco for three days straight.

- Industry-wide: AI/data centers responsible for 2.5–3.7% of world greenhouse gas emissions—more than the entire aviation sector.

- Water crisis: Google’s Iowa data center alone used 1 billion gallons in 2024; U.S. data center water use projected to quadruple by 2028.

As AI deployments scale, energy and resource efficiency, “green AI,” and reporting requirements are shooting up the regulatory and business agenda.

Regulation Rides to the Rescue—or Risk of Overreach?

The biggest regulatory story in 2025 is the EU AI Act, the world’s first comprehensive legal framework for AI deployment and ethics. Effective since August 2024, with compliance milestones throughout 2025–2026, it brings sweeping obligations for anyone building, deploying, or selling AI in Europe—even if they’re based elsewhere.

- AI Risk Tiers: Bans some uses (e.g., live biometric surveillance), heavily regulates “high-risk” sectors (healthcare, HR), and sets transparency laws for general-purpose AI (including OpenAI, MidJourney, Meta, etc.).

- Penalties: Fines can hit €35 million or 7% of global turnover.

- Global impact: The “Brussels Effect” ensures AI companies worldwide must comply, and other nations are adapting similar frameworks.

- Compliance burden: Particularly tough for smaller companies and startups, with required audits, transparency, data governance, and bias/fairness locks.

U.S. action: Meanwhile, U.S. federal agencies more than doubled AI-related regulations in 2024, with ongoing debates about innovation versus social risk and new AI “safety incident” reporting in the pipeline.

Responsible AI: Building for the Plateau, Not the Peak

For all its turbulence, the AI field is making serious progress in moving beyond hype to responsible deployment:

- Responsible AI audits and evaluation frameworks are being rapidly deployed across Big Tech—now considered essential to win customer and regulator trust.

- AI Trust, Risk, and Security Management (AI TRiSM): A core theme for 2025, with layered controls for bias, privacy, explainability, and monitoring, especially as models grow in complexity and impact.

- Regulatory sandboxes, transparency tools, and “AI assurance” startups are beginning to flourish, helping firms navigate shifting rules.

- Environmental reporting and “Green AI” are quickly moving from CSR talking points to compliance requirements and procurement criteria.

Not Everyone’s Lining up for a Crash: Contrarian Voices

Despite the warnings, not all experts are certain AI is destined for a catastrophic bust.

Goldman Sachs and industry insiders point out that leading AI companies—Nvidia, Google, Microsoft—are fundamentally different from Pets.com or Enron; they’re profitable, cash-rich market makers building essential digital infrastructure. Unlike blockchain and dot-com, where financialization and speculation overtook real use, the AI boom is grounded in operational efficiency (code, customer service, logistics) even if the ROI lags hype.

- “Those who remain level-headed through this moment have a chance to build extremely important companies…. The dot-com bubble of the 1990s saw much higher over-investment and overvaluation than what the AI industry is experiencing today, yet its collapse paved the way for giants like Google and Amazon. The same will likely be true for a select few AI companies.” (Sequoia Capital, paraphrased in Built In).

Moreover, the “bubble burst” may not be a catastrophic pop so much as a multi-year, “painful healing and self-correction”—with unviable ventures failing and strong survivors consolidating market share, exactly as happened post-2000.

Forward-Looking Insights: How Long Until AI’s Real Payoff?

Timelines for productivity and economic change are longer than most headlines admit:

- Most researchers now forecast that AI’s true macroeconomic boost will take a decade or more to become visible. Stanford and Wharton projections estimate cumulative productivity and GDP growth of only 1.5% by 2035, with peak impact not before the early 2030s—well after the initial hype wave.

- Automation will be most disruptive in some sectors, but even where AI can automate 90–100% of tasks, job elimination is rarely complete; just 1% of US jobs are fully automatable without oversight under current models.

- Skills and workforce adaptation are lagging: Less than a third of companies have upskilled even a quarter of their staff on AI—meaning the dream of “instant transformation” is mostly myth.

- Open-source innovation, efficiency breakthroughs (smaller models), and regulatory guardrails may accelerate progress, but no one expects a universal AGI moment this decade.

Case Studies: When (and Why) AI Projects Fail

Nothing shakes investor faith like high-profile stumbles. AI, in this regard, is no exception:

- IBM Watson for Oncology: Once predicted to revolutionize cancer treatment, ultimately abandoned after $62 million and unsafe treatment recommendations. IBM failed to scale from research prototype to clinical reality, a classic moonshot turned cautionary tale.

- Amazon’s Recruitment AI: Canned after discovering the AI had internalized—and perpetuated—gender bias, scoring male-coded CVs higher due to historical training data.

- Microsoft’s ‘Tay’ Chatbot: Designed to learn human conversation, it was rapidly corrupted by social media, spouting offensive remarks and prompting a hasty shutdown.

- AI Facial Recognition Fiascos: Multiple incidents, from Amazon Rekognition to Apple FaceID, where AI systems misidentified or failed to recognize individuals, exposing limitations and raising privacy/bias concerns.

These are not just technical mishaps but reminders that insufficient oversight, flawed data, or misaligned incentives can doom even the most promising AI projects.

Conclusion: Beyond the Bubble—Charting a Sustainable AI Future

The AI boom of 2023–2025 is the wildest ride yet in the pantheon of tech hype cycles. By most hard numbers, there is an AI bubble—marked by speculative investment, immense infrastructure bets, and extraordinarily mismatched expectations. The parallels with dot-com and blockchain are real, and a painful shakeout appears inevitable.

But unlike tulips, Beanie Babies, or vaporware dot-com startups, AI has already planted deep roots in business operations, science, and daily life. Its infrastructure, algorithms, and data are unlikely to vanish in the next correction. If history repeats, a correction will clear the field for more disciplined, focused, and truly transformative innovation. As Bill Gates noted, “People overestimate what they can do in one year and underestimate what they can do in 10 years.”

For those building, investing, or simply living through the AI era, the challenge is clear: temper FOMO with realism, shift energy from hype to integration and workforce adaptation, and embrace responsible, measured rollout—knowing the next phase of the journey will favor the patient, the principled, and the prepared.

Stay tuned, stay skeptical, and remember: the real AI revolution has only just begun.

Comments ()